43 what is a 20-1 stock split

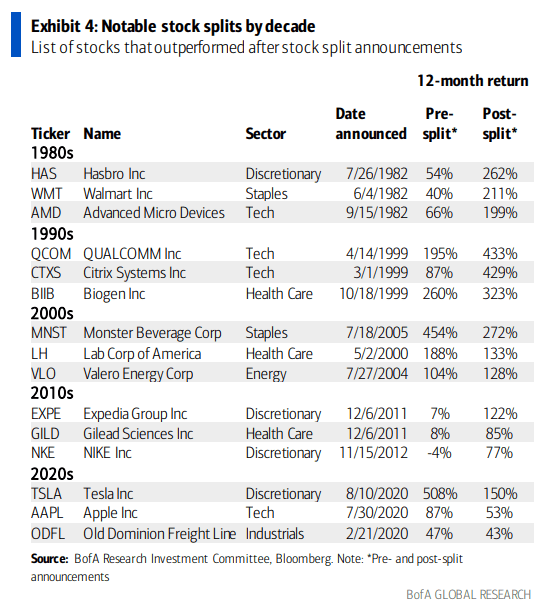

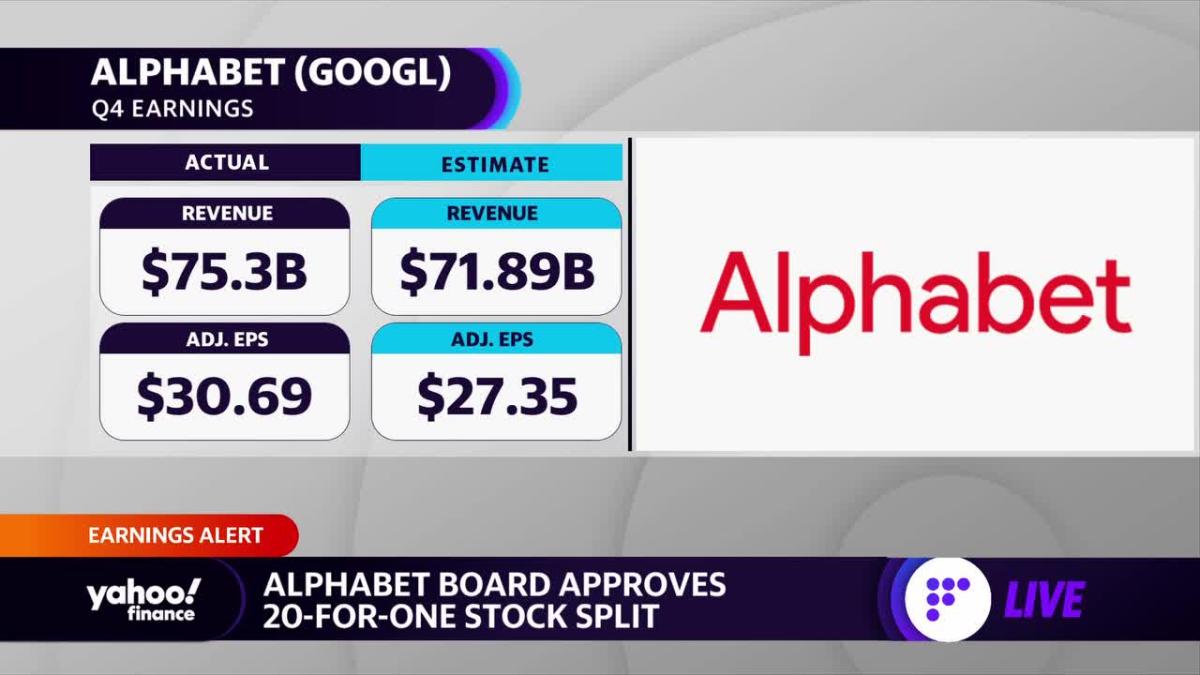

› article › internationalGoogle parent Alphabet seeks more investors in 20-for-1 stock ... Feb 02, 2022 · The stock split could lead to Alphabet’s listing on the Dow Jones Industrial Average, one of the most commonly quoted indexes that holds 30 blue-chip companies. It could also help the company on its path to cross a $2 trillion market cap. A prior stock split happened in 2014, after the company’s shares topped $1,000. › alphabet-stock-splitAlphabet's 20-for-1 stock split could entice other companies ... Feb 08, 2022 · Alphabet’s upcoming 20-for-1 stock split could entice others to do the same and spark a wave of inflows into the mega-cap tech giants that retail investors have shunned due to high stock prices ...

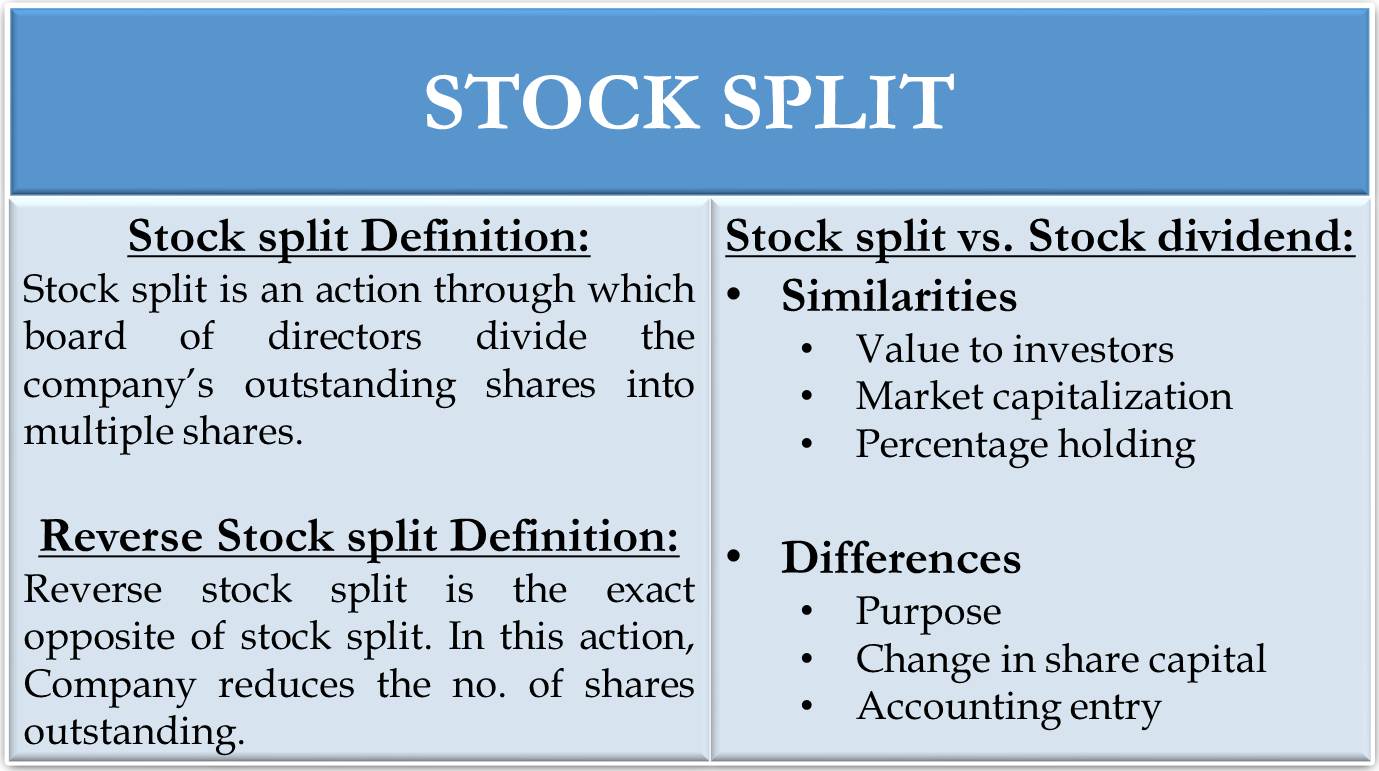

Stock Split Definition - Investopedia A stock split happens when a company increases the number of its shares to boost the stock's liquidity. Although the number of shares outstanding increases ...What Happens If I Own Shares that Undergo a Stock Split?Are Stock Splits Good or Bad?

What is a 20-1 stock split

Amazon Stock Split: What You Need To Know – Forbes Advisor nairametrics.com › 2022/02/02 › google-declares-20Google declares 20-for-1 stock split, posts record Q4 ... Feb 02, 2022 · As part of the tech company’s quarterly earnings statement on Tuesday, Alphabet’s (parent company of Google) board approved plans for a 20-for-1 stock split. Following the news, the stock of Alphabet rose by more than 9% after market. Recall that Apple split its stock in the past year and a half, giving each shareholder three shares for ... › stock-splits2022 Stock Split Calendar | Reverse Stock Splits | MarketBeat In a reverse stock split, the number of outstanding shares decreases and the price per share increases. A practical example is giving somebody a $20 dollar bill for their two $10 bills. Let’s look at a reverse stock split from the point of view of a company and an investor. Company A has 8 million outstanding shares valued at $2.50 share.

What is a 20-1 stock split. › stock-splits2022 Stock Split Calendar | Reverse Stock Splits | MarketBeat In a reverse stock split, the number of outstanding shares decreases and the price per share increases. A practical example is giving somebody a $20 dollar bill for their two $10 bills. Let’s look at a reverse stock split from the point of view of a company and an investor. Company A has 8 million outstanding shares valued at $2.50 share. nairametrics.com › 2022/02/02 › google-declares-20Google declares 20-for-1 stock split, posts record Q4 ... Feb 02, 2022 · As part of the tech company’s quarterly earnings statement on Tuesday, Alphabet’s (parent company of Google) board approved plans for a 20-for-1 stock split. Following the news, the stock of Alphabet rose by more than 9% after market. Recall that Apple split its stock in the past year and a half, giving each shareholder three shares for ... Amazon Stock Split: What You Need To Know – Forbes Advisor

0 Response to "43 what is a 20-1 stock split"

Post a Comment