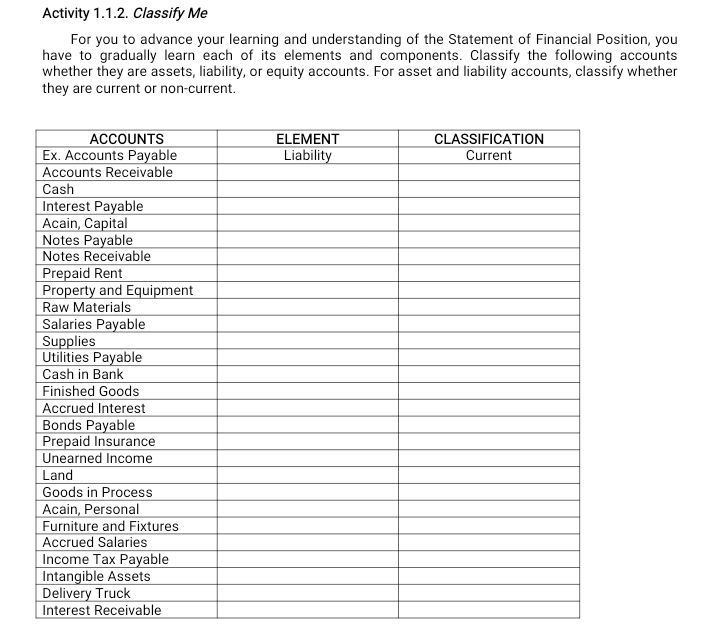

42 notes payable asset or liability

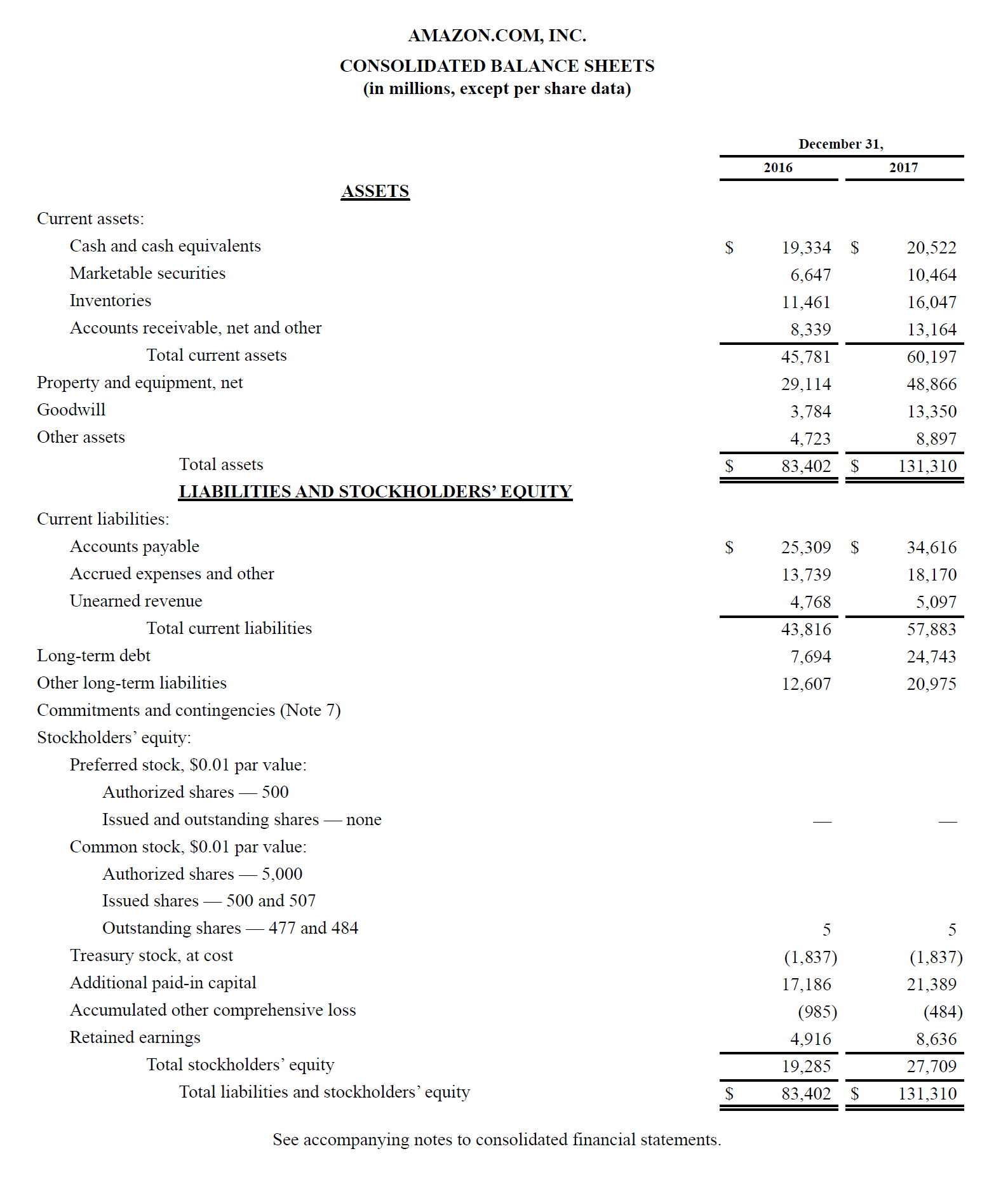

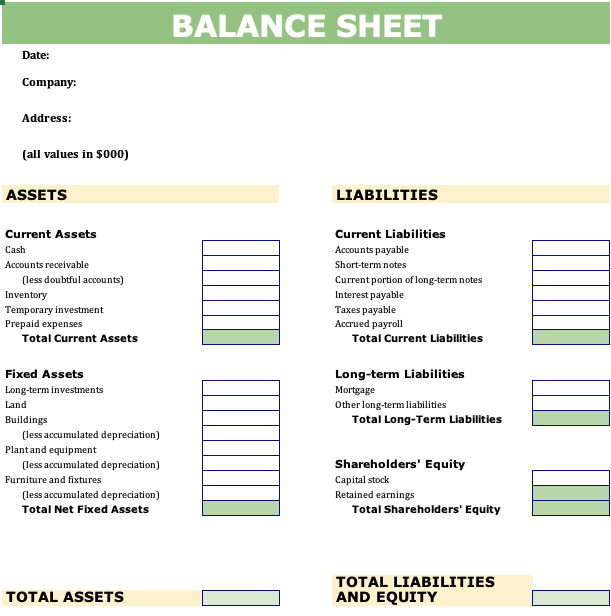

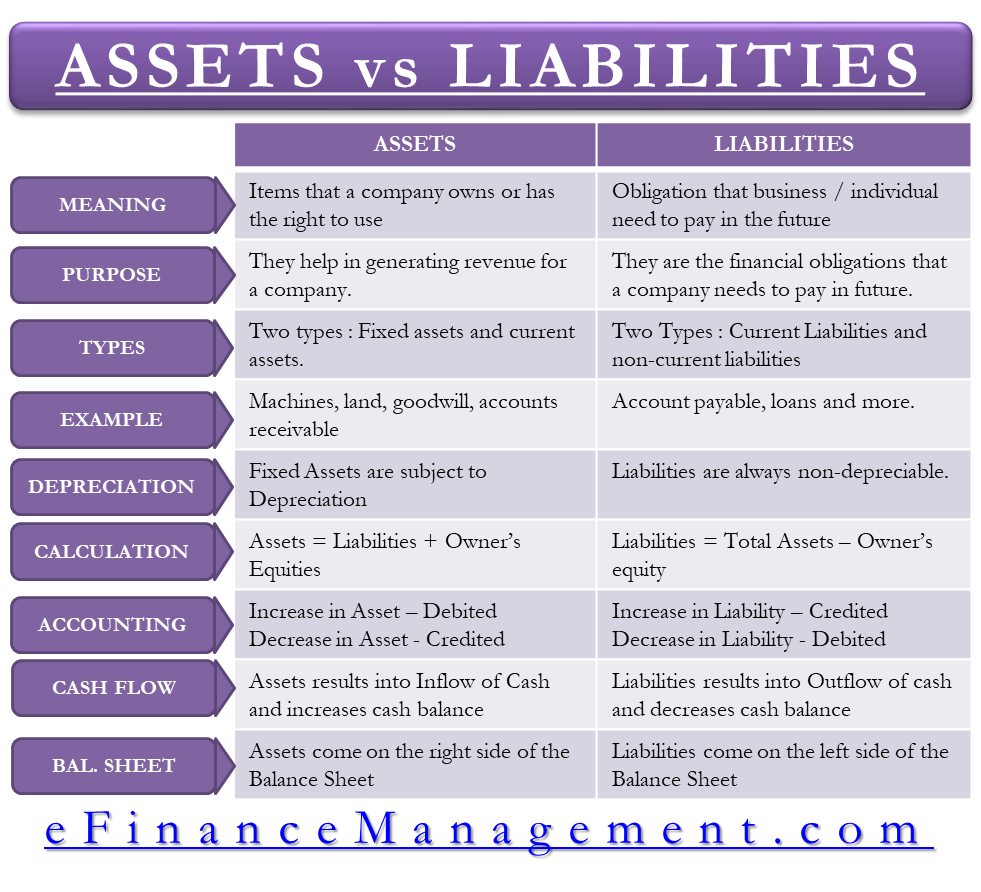

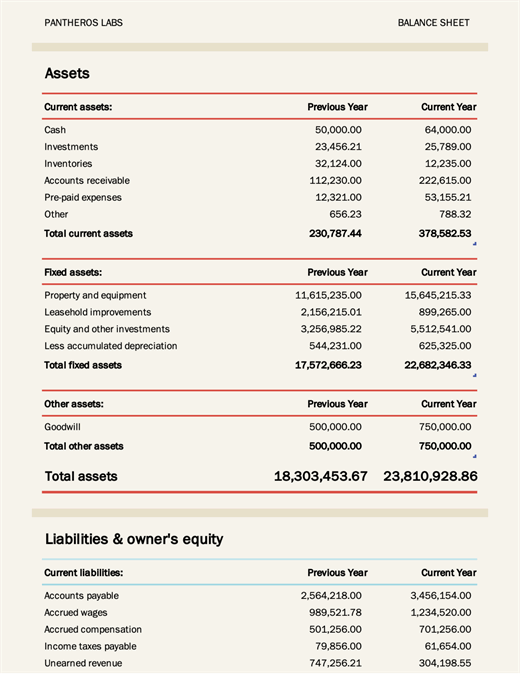

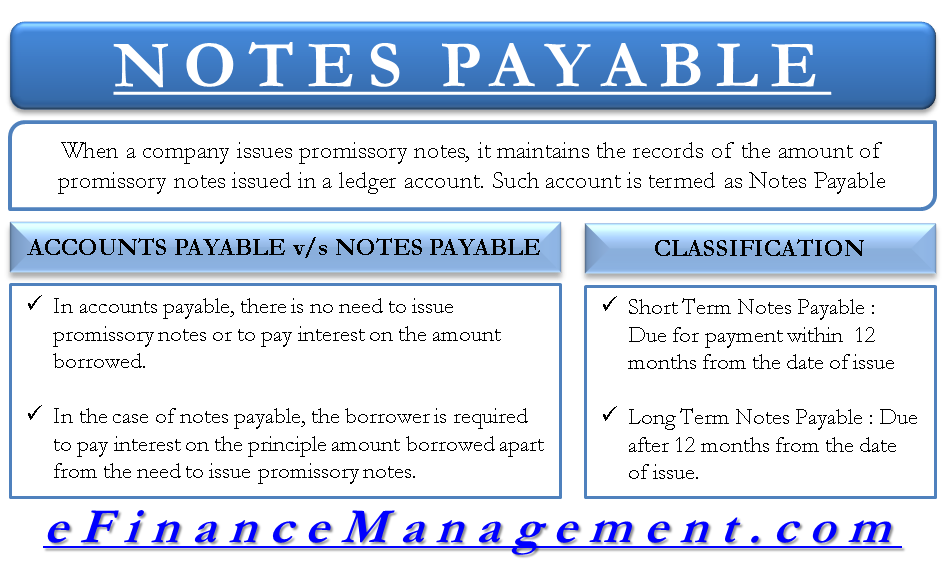

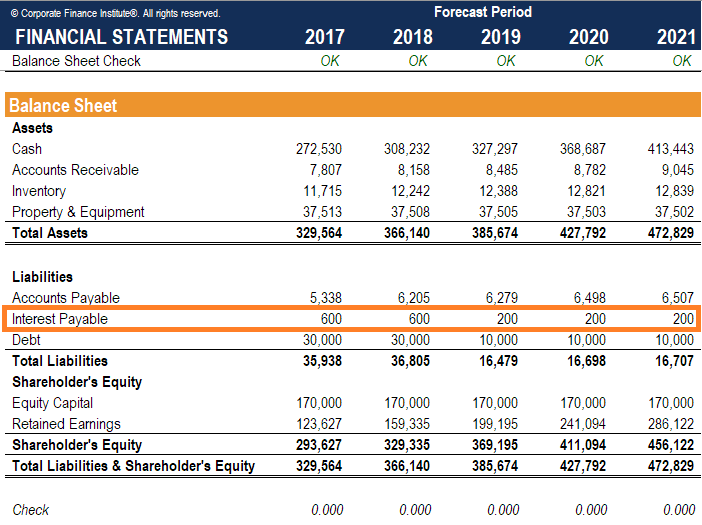

Are notes payable current or long term liabilities? Definition of Notes Payable The balance in Notes Payable represents the amounts that remain to be paid. the amount due within one year of the balance sheet date will be a current liability, and. the amount not due within one year of the balance sheet date will be a noncurrent or long-term liability. Click to see full answer. What is Notes Payable? - AccountingCoach.com Definition of Notes Payable In accounting, Notes Payable is a general ledger liability account in which a company records the face amounts of the promissory notes that it has issued. The balance in Notes Payable represents the amounts that remain to be paid.

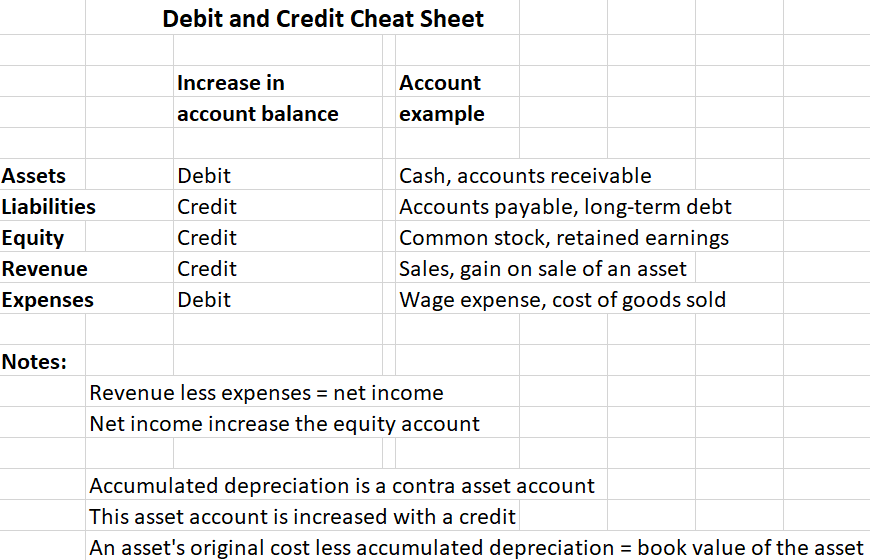

Notes Payable Accounting | Double Entry Bookkeeping Mar 18, 2020 · Are notes payable interest bearing debt? Yes. A note payable is an interest bearing debt. Where is notes payable on balance sheet? A note payable is shown under either current or long term liabilities on the balance sheet. Is a note payable an asset? No. A note payable is a liability. Do notes payable go on an income statement? No.

Notes payable asset or liability

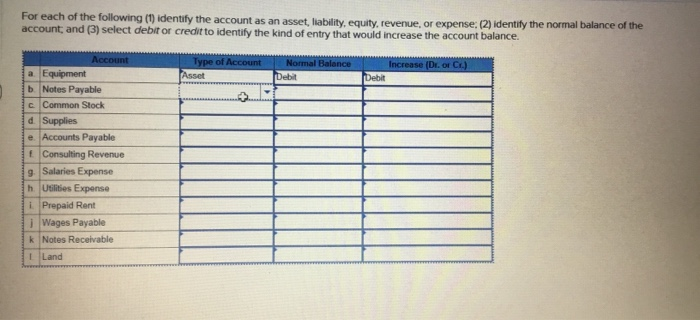

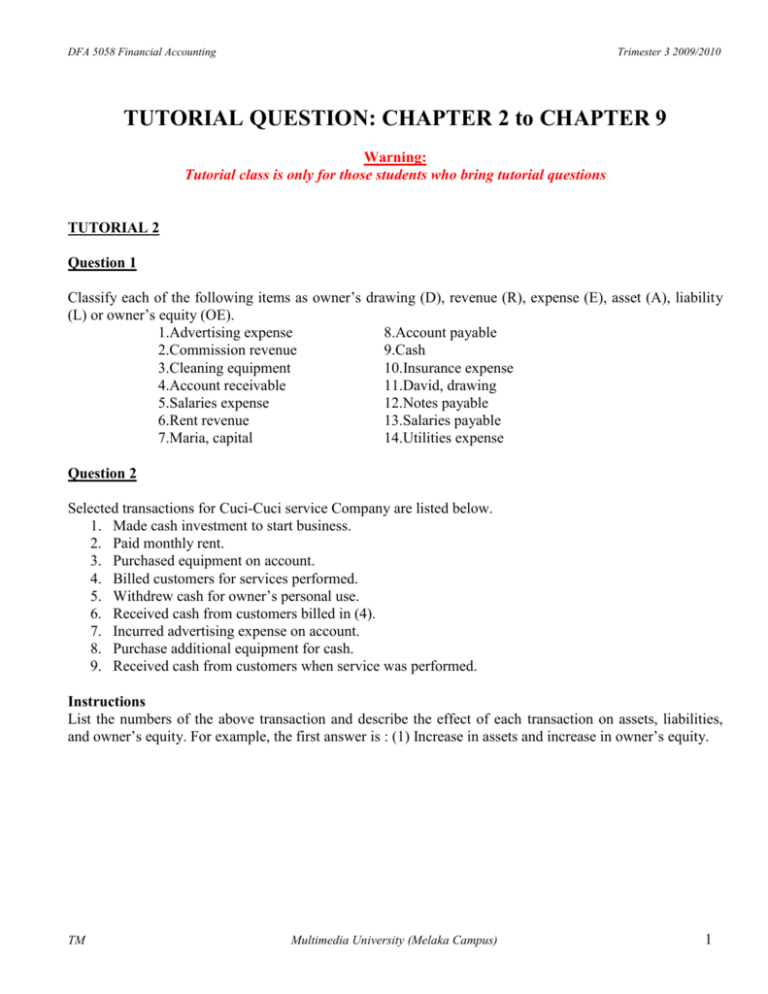

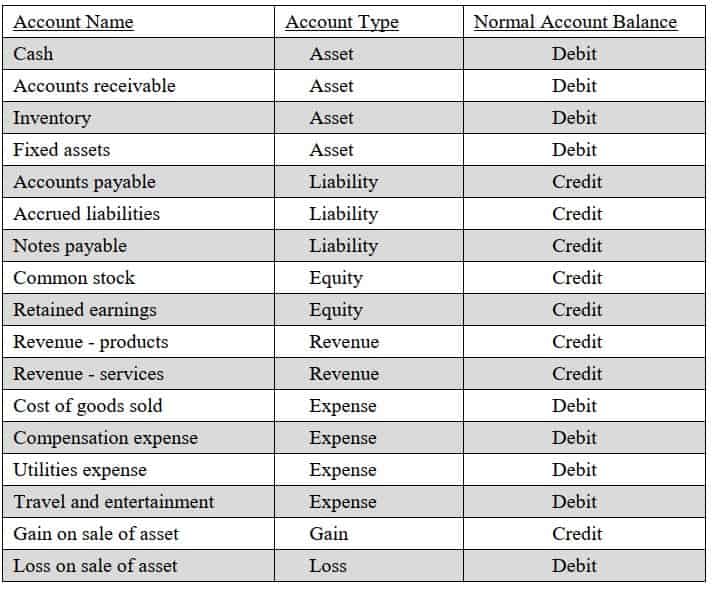

Assets, Liabilities, or Equity?? Flashcards | Quizlet Start studying Assets, Liabilities, or Equity??. Learn vocabulary, terms, and more with flashcards, games, and other study tools. ... Notes receivable. Asset - increases with debit journal entry. Equipment. Asset - increases with debit journal entry. Accounts payable. Liability - increases with credit journal entry. Wages payable. Liability ... give an example of each of the following increase in asset ... Jun 13, 2016 · Decrease in liability and increase in another liability. ii. Bills payable issued to creditors. Increase in bill payable and decrease in liability. iii. Decrease in asset and decrease in owner’s equity. iii. Drawings by the proprietor Decrease in liability (capital) and decrease in asset (cash or bank) iv. Answered: Total Asset P 57,7 Liabilities and… | bartleby Transcribed Image Text: Ackerman Limousine Service Balance Sheet December31, 2020 Assets Cash P 16,000 Accounts Receivable 2,500 Automobile Supplies 1,200 Limousines 38,000 Total Asset P 57.700 Liabilities and Capital Accounts Payable P 3,200 Notes Payable 30,350 Total Liabilities P 33,550 Mikasa Ackerman, Capital 24,150 Total Liabilities and Capital P.57,700

Notes payable asset or liability. What are Notes Receivable? - Examples and Step-by-Step Guide Notes Payable is a liability as it records the value a business owes in promissory notes. Notes Receivable are an asset as they record the value that a business is owed in promissory notes. A closely related topic is that of accounts receivable vs. accounts payable. Additional Resources. Thank you for reading our guide to Notes Receivable. NOTE 5 - Liabilities Payable from Restricted Assets ... Notes & Samples. NOTE 5 - Long-Term Liabilities Liabilities Payable from Restricted Assets. Liabilities payable from restricted assets are liabilities associated with the acquisition of restricted assets or liabilities that will be liquidated with restricted assets. Segregate current liabilities from long-term liabilities and report separately. Notes Payable Journal Entry | Example - Accountinguide Notes Payable Journal Entry Overview. Notes payable is a promissory note that represents the loan the company borrows from the creditor such as bank. Likewise, the company needs to make the notes payable journal entry when it signs the promissory note to … Is Accounts Payable A Liability Or An Asset? | PLANERGY ... Note: Companies can also use accounts payable to purchase assets such as equipment, property, etc. In such a scenario, your accounts team would debit an asset account, rather than an expense account, for the first entry. Managing Your Liabilities Effectively Can Be an Asset

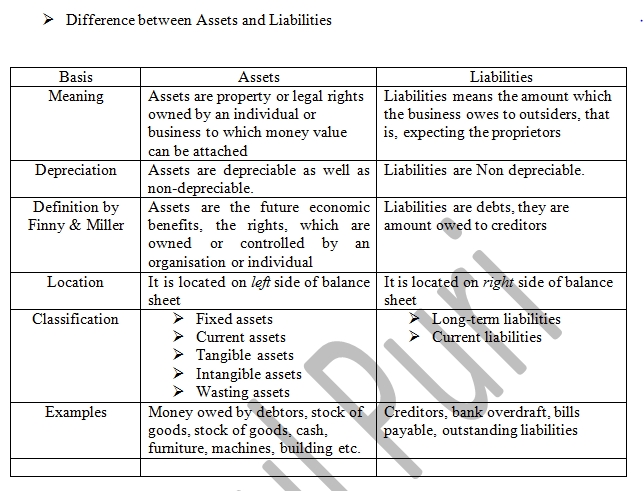

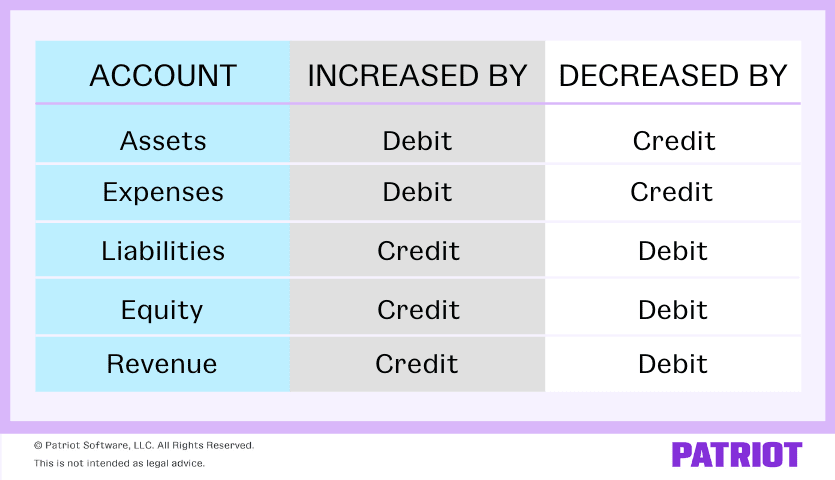

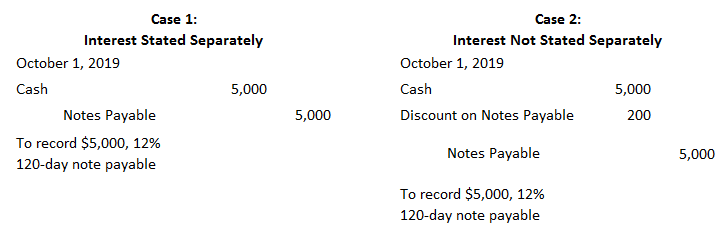

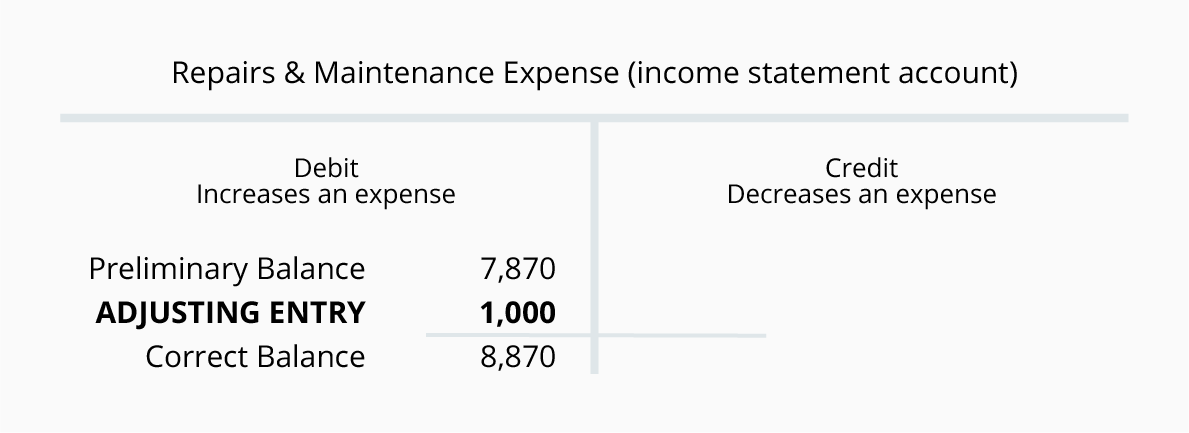

Accounting Principles II: Understanding Notes Payable Understanding Notes Payable Understanding Notes Payable A liability is created when a company signs a note for the purpose of borrowing money or extending its payment period credit. A note may be signed for an overdue invoice when the company needs to extend its payment, when the company borrows cash, or in exchange for an asset. Contra Liability Account Definition - Investopedia Jul 31, 2021 · Contra Liability Account: A liability account that is debited in order to offset a credit to another liability account. The contra liability account is used to adjust the book value of an asset or ... Accounts Payable - General Ledger Account | AccountingCoach General Ledger Account: Accounts Payable. The general ledger account Accounts Payable or Trade Payables is a current liability account, since the amounts owed are usually due in 10 days, 30 days, 60 days, etc. The balance in Accounts Payable is usually presented as the first or second item in the current liability section of the balance sheet. Are accounts payable assets, liabilities, or equity ... Examples of the asset include investments, accounts receivable, supplies, land, equipment, and cash. Liabilities. A liability, in general, is an obligation to, or something that you owe somebody else. Liabilities are defined as a company's legal financial debts or obligations that arise during the course of business operations.

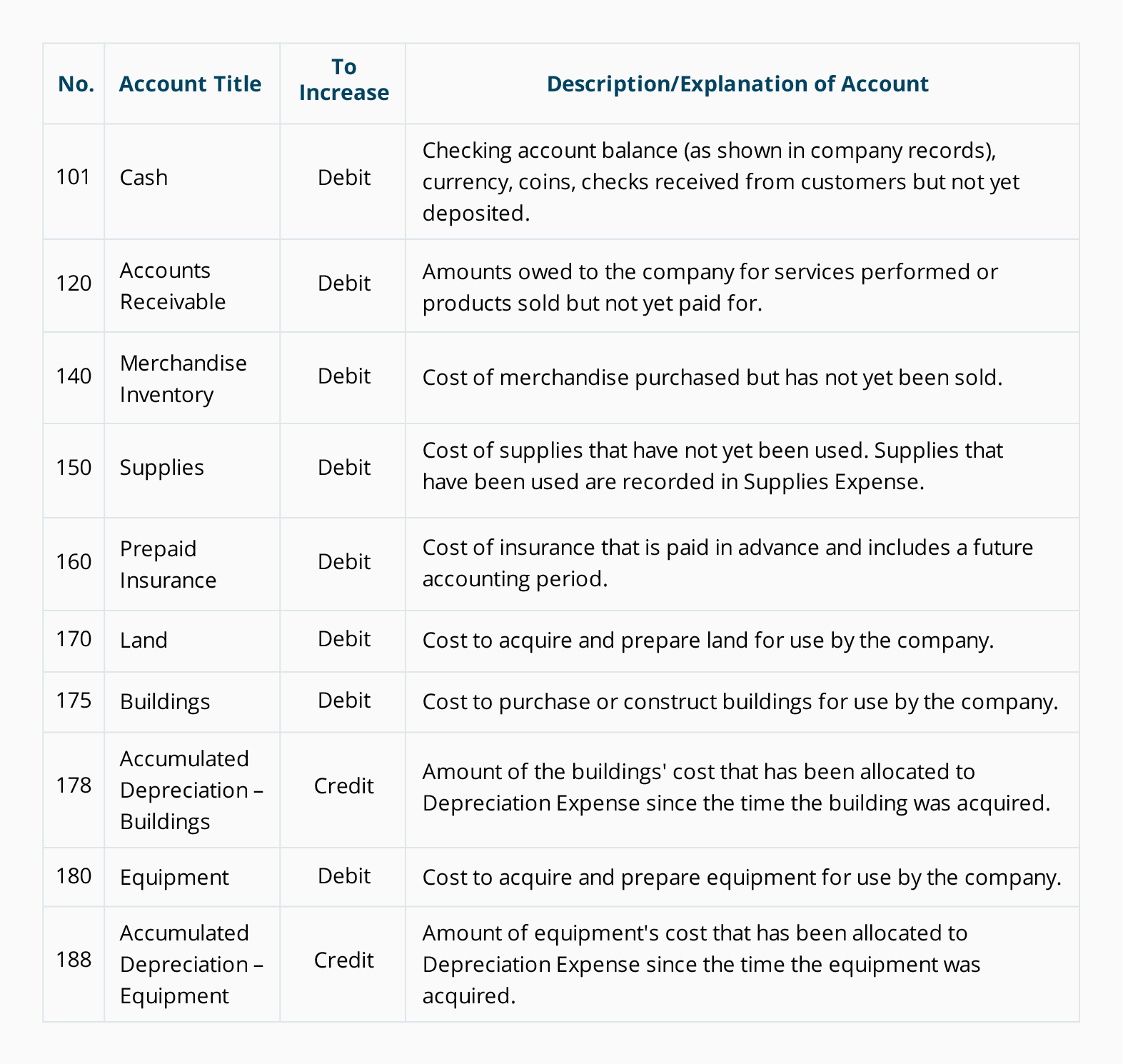

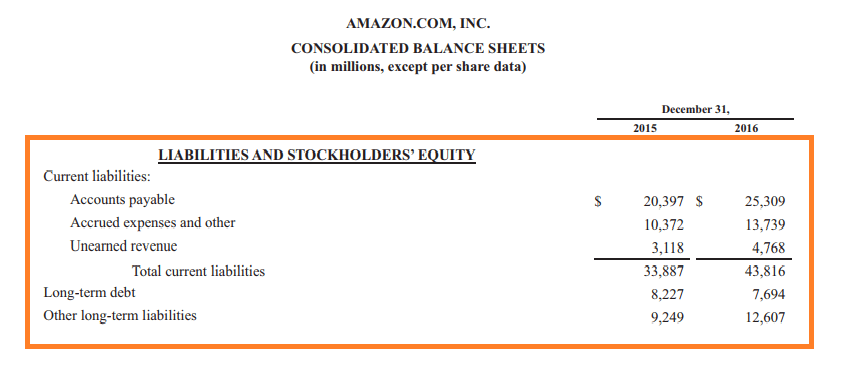

Notes payable definition - AccountingTools Presentation of Notes Payable A note payable is classified in the balance sheet as a short-term liability if it is due within the next 12 months, or as a long-term liability if it is due at a later date. When a long-term note payable has a short-term component, the amount due within the next 12 months is separately stated as a short-term liability. Notes Payable on Balance Sheet (Definition, Journal Entries) Short-Term Notes Payable. Firstly, the company puts notes payable as a short-term liability. The company puts it as a short-term liability when the duration of that particular note payable is due within a year. As we see from the above example, CBRE has a current portion of notes of 133.94 million and $10.26 million in 2005 and 2004, respectively. Accounts Payable: Asset or Liability? | Indeed.com Accounts payable, or AP, is a liability account, while account receivable, or AR, is a current asset account. AP monitors outstanding amounts that a company owes to its vendors, like purchases of goods and services from other companies. These amounts are due within a short period of time. Accounts Payable Vs. Notes Payable: What's The ... - Zippia Notes payable is a liability account maintained in a company's general ledger that tracks their promises to pay specific amounts of money within a predetermined period. Companies short on cash may issue promissory notes to vendors, banks, or other financial institutions to acquire assets or borrow funds.

Is notes payable an asset or a liability? - Answers Best Answer Copy Accounts Payable and Notes Payable are liabilities. Accounts receivable - assets All "payable" accounts are "liabilities". This is because a liability is something the company...

A Beginner's Guide to Notes Payable | The Blueprint Notes payable is a formal agreement, or promissory note, between your business and a bank, financial institution, or other lender. Unlike accounts payable, which is considered a short-term...

Notes Payable vs. Accounts Payable (With FAQs) | Indeed.com Notes payable keeps track of all promissory notes made by a company to vendors or lenders. This account acts as a liability account, so the company credits the notes payable account while it debits cash or another asset against it.

How to Calculate Notes Payable & Long-Term Liabilities on ... Notes payable refers to money borrowed for the company for which the company issues a promissory note to the lender. The promissory note includes the face value of the note, the interest rate and the term of the note. A note payable can be a current liability if it is due within the year or a long-term debt if it extends beyond the year.

Accounts Payable Vs Notes Payable: 7 Differences you ... Payable liability is likely to have collateral security attached to it. It is worthy of note that NP also has an interest rate with a specified repayment date. The borrower is therefore aware of the time of repaying the debt and the specific amount to be paid back to the lender. Differences between Account Payable and Notes Payable

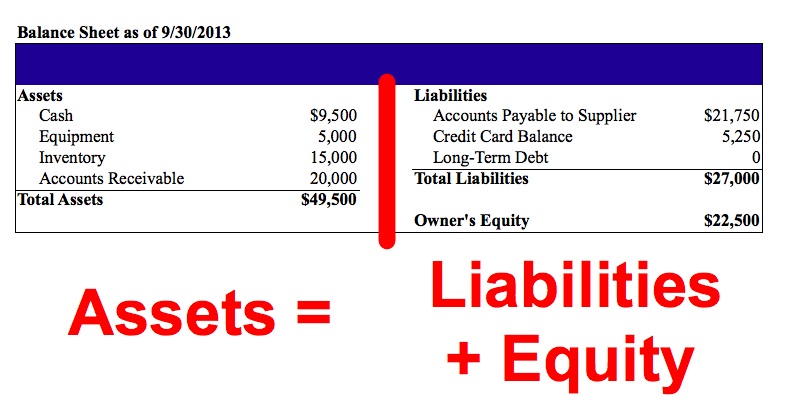

Is discount on notes payable an asset? - AskingLot.com Assets = Liabilities + Equity of a business. While Notes Payable is a liability, Notes Receivable is an asset. Notes Receivable record the value of promissory notes that a business should receive, and for that reason, they are recorded as an asset. Likewise, people ask, what is discount on notes payable? discount on notes payable definition.

Solved Consider the following accounts and identify each ... Answer: a Notes Receivable A b Nunez, Capital E c Prepaid insurance A d Notes payable L… View the full answer Transcribed image text : Consider the following accounts and identify each account as an asset (A), liability (L), or equity (E).

What Is The Difference Between Notes Payable And Accounts ... While Notes Payable is a liability, Notes Receivable is an asset. Notes Receivable record the value of promissory notes that a business owns, & for that reason, they are recorded as an asset. NP is a liability which records the value of promissory notesthat a business will have lớn pay.

Notes Payable: U.S. GAAP Accounting Definition Notes Payable Definition The "Notes Payable" line item is recorded on the balance sheet as a current liability - and represents a written agreement between a borrower and lender specifying the obligation of repayment at a later date. Also contained within the notes payable are the terms stipulated between the two parties, such as:

Notes Payable - Learn How to Book NP on a Balance Sheet While Notes Payable is a liability, Notes Receivable is an asset. Notes Receivable record the value of promissory notes that a business owns, and for that reason, they are recorded as an asset. NP is a liability which records the value of promissory notes that a business will have to pay.

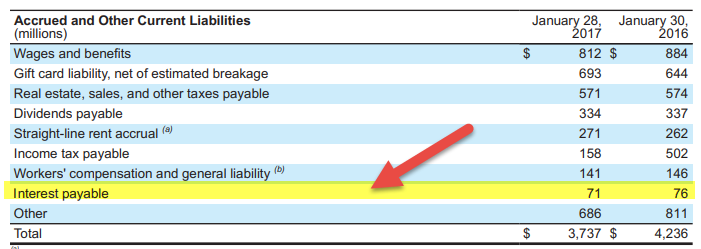

asset, liability, stockholders' equity, revenue, or ... Start studying asset, liability, stockholders' equity, revenue, or expense?. Learn vocabulary, terms, and more with flashcards, games, and other study tools. ... notes payable. liability (balance sheet) ... liability (balance sheet) salaries and wages payable. liability (balance sheet) interest payable. liability (balance sheet) common stock ...

Notes Payable Journal Entry: (Example and How to Record ... Both Notes payable and current liabilities are the results of a past transaction that obligates the entity. Current liabilities are one of two-part of liabilities, and hence, Notes payable are liabilities. The nature of Notes payable does not match with those of assets or equity in a nutshell.

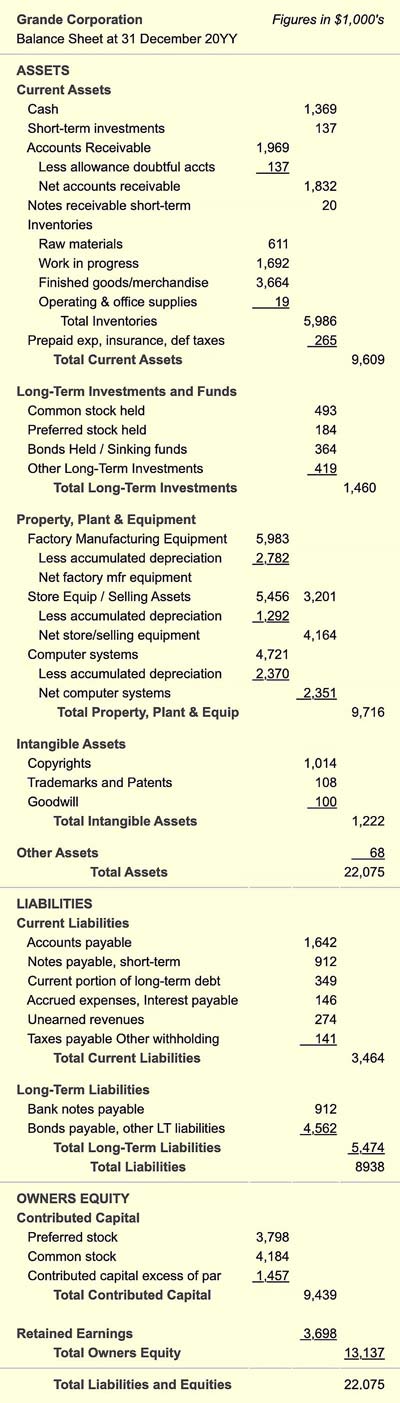

Balance Sheet - Liabilities, Current Liabilities ... Short-term loans payable could appear as notes payable or short-term debt. For instance, if a company obtains a 6-month bank loan on December 31, 2021 for $100,000 and agrees to pay interest at the end of each month at the annual interest rate of 10%, the company's balance sheet as of December 31, 2021 will report a current liability of $100,000.

Accounts Payable - Related Expense or Asset | AccountingCoach As a result these amounts will not have been entered into the Accounts Payable account (and the related expense or asset account). These documents should be reviewed in order to determine whether a liability and an expense have actually been incurred by the company as of the end of the accounting period.

Solved Indicate whether each of the following ... - Chegg Indicate whether each of the following items is an asset, liability, or part of stockholders' equity. (a) Accounts receivable. Liability/ Stockholders' Equity/ Asset. (b) Salaries and wages payable. Liability/ Stockholders' Equity/ Asset.

How Do Accounts Payable Show on the Balance Sheet? Other current liabilities can include notes payable and accrued expenses. Current liabilities are differentiated from long-term liabilities because current liabilities are short-term obligations...

Answered: Total Asset P 57,7 Liabilities and… | bartleby Transcribed Image Text: Ackerman Limousine Service Balance Sheet December31, 2020 Assets Cash P 16,000 Accounts Receivable 2,500 Automobile Supplies 1,200 Limousines 38,000 Total Asset P 57.700 Liabilities and Capital Accounts Payable P 3,200 Notes Payable 30,350 Total Liabilities P 33,550 Mikasa Ackerman, Capital 24,150 Total Liabilities and Capital P.57,700

give an example of each of the following increase in asset ... Jun 13, 2016 · Decrease in liability and increase in another liability. ii. Bills payable issued to creditors. Increase in bill payable and decrease in liability. iii. Decrease in asset and decrease in owner’s equity. iii. Drawings by the proprietor Decrease in liability (capital) and decrease in asset (cash or bank) iv.

Assets, Liabilities, or Equity?? Flashcards | Quizlet Start studying Assets, Liabilities, or Equity??. Learn vocabulary, terms, and more with flashcards, games, and other study tools. ... Notes receivable. Asset - increases with debit journal entry. Equipment. Asset - increases with debit journal entry. Accounts payable. Liability - increases with credit journal entry. Wages payable. Liability ...

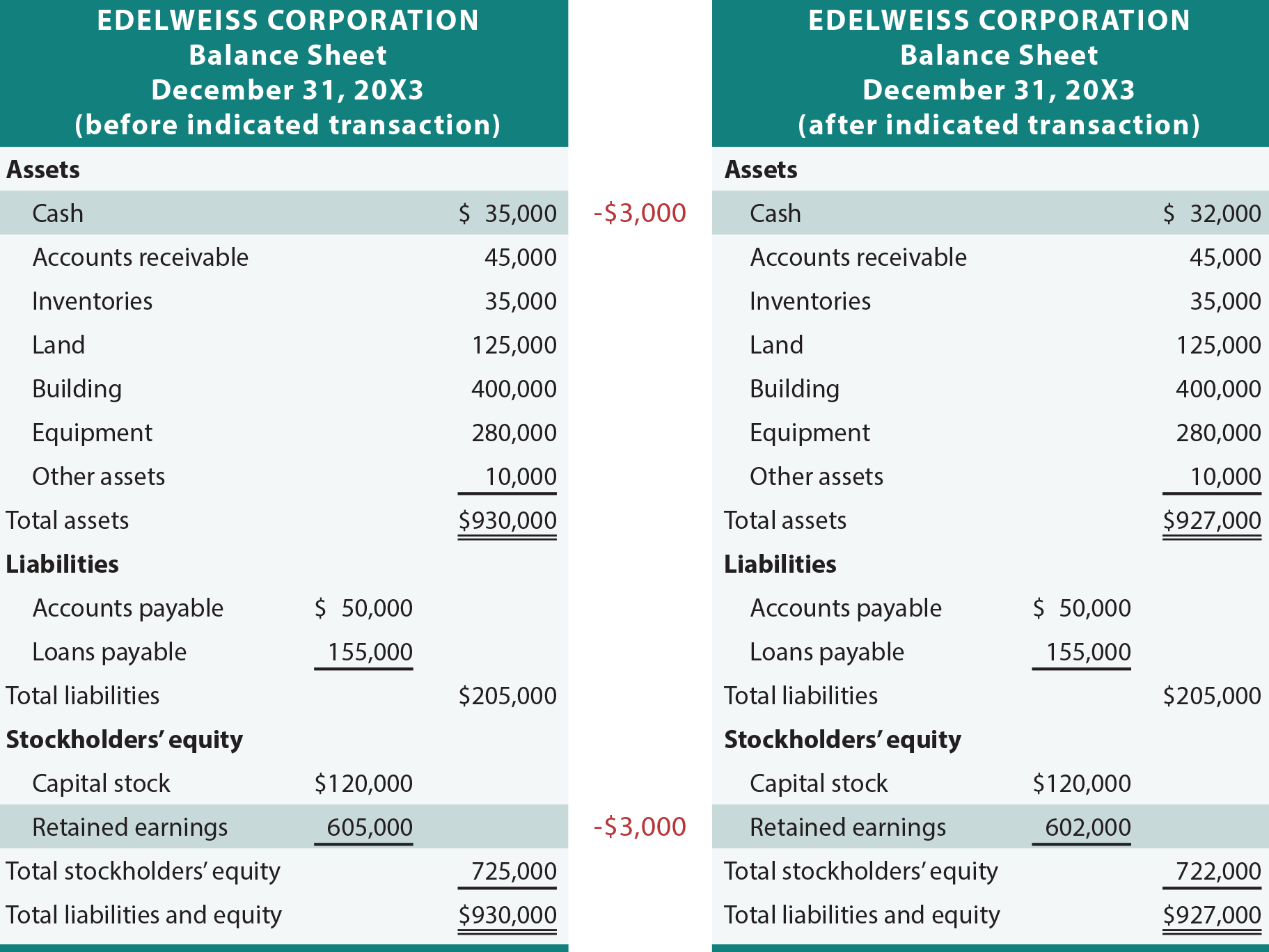

/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)

0 Response to "42 notes payable asset or liability"

Post a Comment