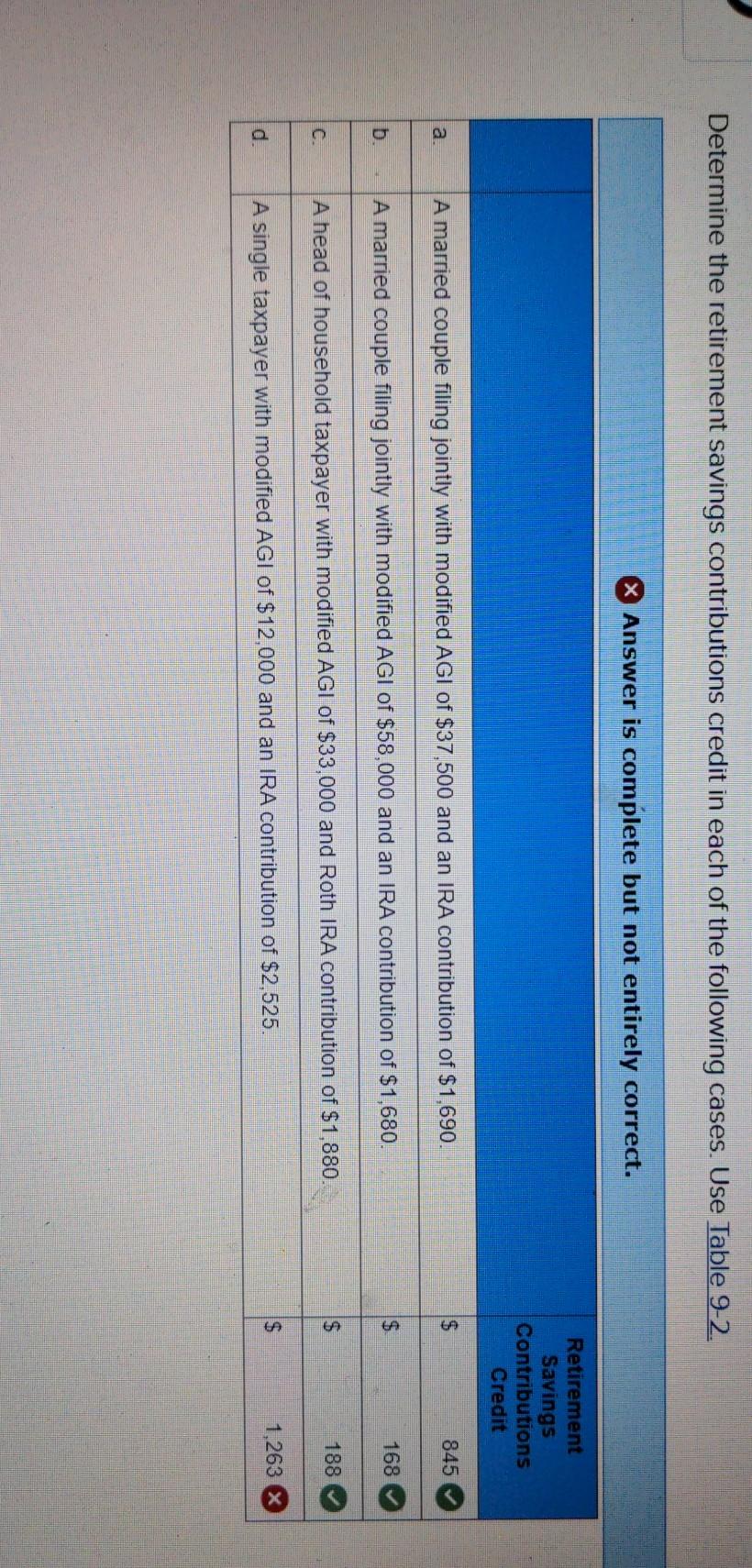

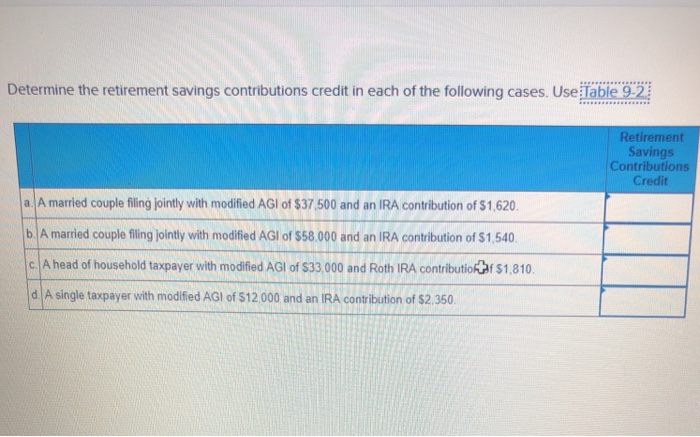

41 retirement saving contribution credit

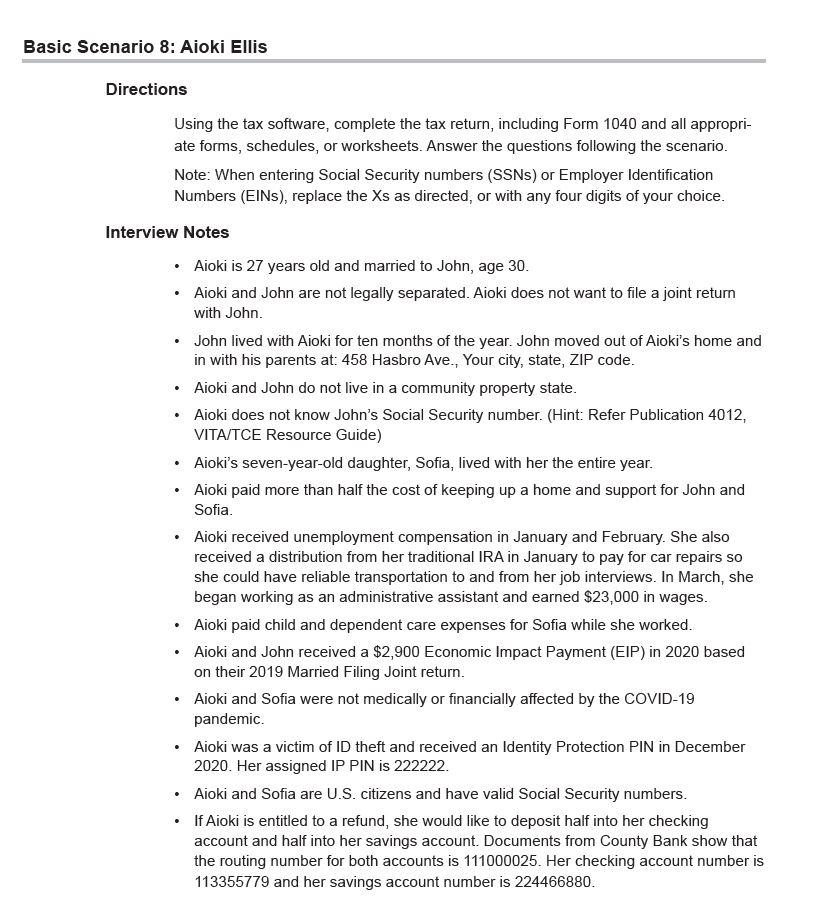

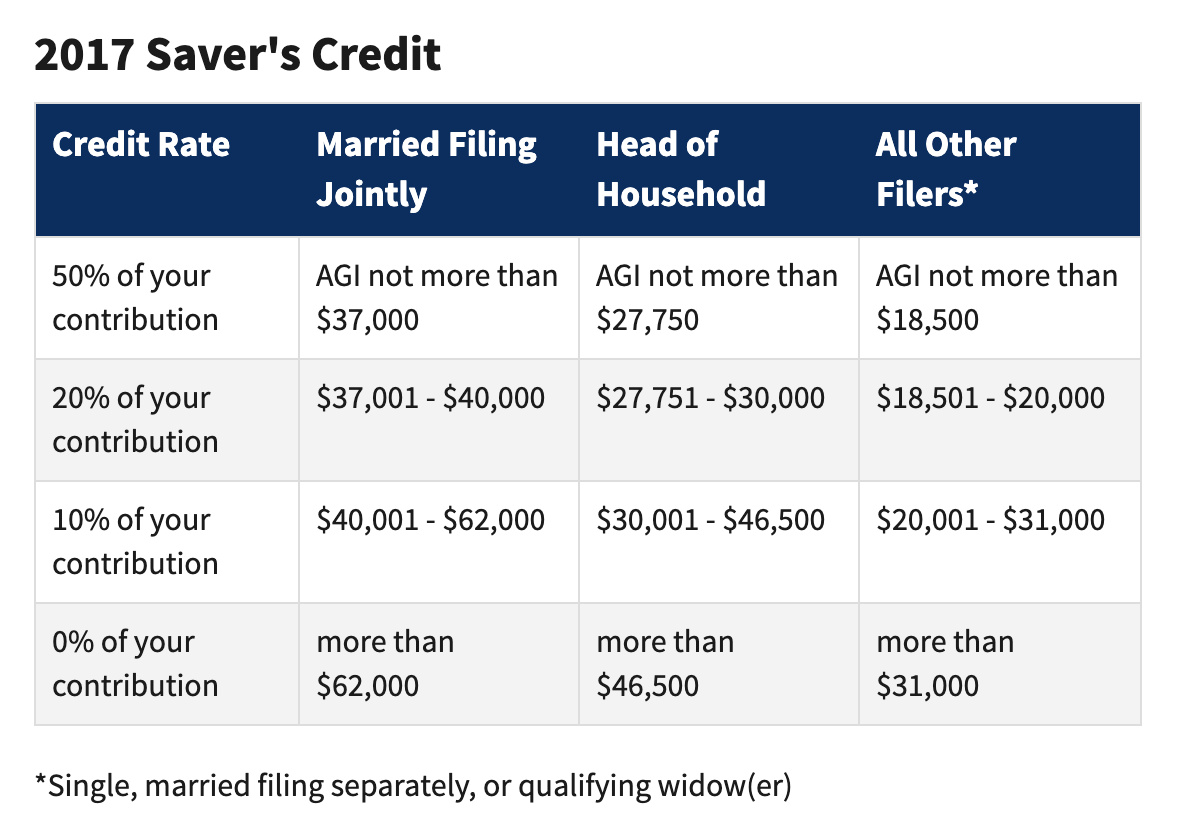

Retirement Savings Contribution Credit (Saver's Credit) To promote saving for retirement, the United States government provides a retirement savings contribution credit, otherwise known as the saver's credit, for low income taxpayers that could be as high as $1000 for a $2000 contribution. Saver's Credit: What It Is & How It Works in 2021-2022 - NerdWallet The retirement savings contribution credit — the saver's credit — is a retirement savings incentive. But that doesn't necessarily mean you get it: You must also make a retirement plan or IRA account contribution, and fall under maximum adjusted gross income caps the IRS sets each year.

What is the Retirement Savings Contributions Credit? The Retirement Savings Contribution Credit (aka the "Saver's Credit") is a tax credit that the IRS offers to incentivize low and moderate income taxpayers to make retirement contributions to an eligible retirement account (e.g. IRA, 401K, 403B, 457B...

Retirement saving contribution credit

Contribute to a Saver's Credit Qualifying Retirement Account This retirement savings contributions credit can be claimed in addition to any tax deduction you earn by contributing to a traditional retirement account. There are several types of retirement accounts that might qualify you for the saver's credit. Contributing to a 401(k) plan will often allow you to claim... Saver's Credit - Get It Back | Individual Retirement Accounts Individual Retirement Accounts. Contributions to both traditional and Roth IRAs are eligible for the Saver's Tax Credit. Workers that can deduct IRA contributions can do so and also claim the credit. Workers must complete IRS Form 8880,"Credit for Qualified Retirement Savings Contributions... Registered retirement savings plan - Wikipedia A registered retirement savings plan (RRSP) (French: régime enregistré d'épargne-retraite, REER), or retirement savings plan (RSP), is a type of financial account in Canada for holding savings and investment assets.

Retirement saving contribution credit. Saver's Credit: How To Get Free Money To Save for Retirement In 2001, Congress passed the Retirement Savings Contributions Credit (Saver's Credit). The measure is designed to help savers who make a decent living but not a huge income. If you stash cash in your workplace retirement account, IRA or Achieving a Better Life Experience (ABLE) plan, the... Retirement Savings Options | Navy Federal Credit Union Explore retirement savings accounts from Navy Federal. Learn how members can grow their savings through a variety of retirement accounts and plans. Retirement Savings Options. Secure Your Future. Our retirement plans can help you reach your goals. New to Saving? Earn a $50 bonus when... Retirement savings contribution credits and more: How Congress... Congress is considering several proposals that could make retirement savings more worthwhile: student loan matching, retirement credits, and more. Secure 2.0 would allow older employees to sock away more money beyond the current annual contribution limits for workplace plans. Retirement Savings Contribution Credit - Fairmark.com Retirement Savings Contribution Credit. By Kaye A. Thomas Current as of January 14, 2021. Details on a credit some taxpayers can claim when they contribute to People with low to moderate income find it hard to save for retirement, so there's a special tax credit designed to help this particular group.

Median Retirement Savings by Age | Synchrony Bank Saving for Retirement in Your 20s. Many Americans in their 20s begin their careers with entry-level paychecks. younger.Your employer may give a matching contribution up to a certain percentage. Take advantage of this offering, but don't stress—you have at least 40 years to build your retirement. How Saving for Retirement Can Reduce Your Taxes With a Credit The Retirement Savings Contributions Credit or Saver's Credit is an incentive that's designed specifically for low- and moderate-income taxpayers. They can claim the credit for a portion of the income they contribute to a qualifying retirement plan. Qualified Retirement Savings Contribution Credit Definition Taxpayers use IRS Form 8880 for the Qualified Retirement Savings Contribution Credit. As of 2021, the credit is available to single taxpayers with a maximum income of $33,000 (rising to $34,000 in 2022). Saver's Tax Credit: Everything You Need To Know About... | Bankrate To file for the retirement savings contribution credit, you need to satisfy three requirements set forth by the IRS What kinds of retirement contributions are not eligible for the tax credit? Taxpayers cannot claim the amounts their employers contributed on their behalf, iCompass' Todd says.

Retirement Savings Contributions Credit: Am I interpreting this... We already contributed $2300 in a Roth IRA in 2019, so that's a credit of $460. Is that really correct? Furthermore, should we dump some more money into our IRAs Running some scenarios based on your figures in turbotax, I show a maximum Retirement Savings Contributions Credit of about $1400. How To Save For Retirement - Forbes Advisor | Credit Repair Saving for retirement doesn't have to be intimidating. Follow these seven steps to develop your Outside of matches, some companies may offer other employer contributions to your retirement SEP IRAs do not allow for employee contributions, but your employer can contribute up to the... Retirement Savings Contribution Credits | Human Interest Retirement Savings Contribution Credits. LAST REVIEWED May 01 2020. If you want to claim the Saver's Credit for your taxes, file Form 8880, Credit for Qualified Retirement Savings Contributions. While you can find instructions in Form 1040EZ, they will send you to Form 8880 for completion. Credit Karma Guide to Saving for Retirement | Credit Karma Saving for retirement is complex, but that doesn't mean you can't figure it out. Learn the fundamentals, including what accounts are available and how Keep in mind that not all companies offer matching on employee retirement savings contributions. Ask your HR representative if it's available at your work...

What is the 2021 Saver's Credit? The Retirement Savings Contributions Credit (Saver's Credit) helps low and middle-income taxpayers save for retirement. Sometimes this is called the Credit for Qualified Retirement Savings Contribution or Retirement Credit.

Saver's Tax Credit for Contributions to Retirement Savings The Saver's Tax Credit lets you save taxes on contributions made to a Retirement Plan. The Saver's Credit, also known as the Credit for Qualified Retirement Savings Contributions, was designed to help lower to middle income ranges: the lower the income, the bigger tax break.

IRS Retirement Savings Contributions Credit — 2021 Saver's Credit Doonan and Rademacher note retirement savings incentives are generally skewed toward higher-income earners, who can get a bigger tax break on, say, 401(k) contributions because they are in a higher tax bracket. The Saver's Credit helps level the playing field, a bit.

Savers Credit | Retirement Savings Contributions Credit - YouTube Savers Credit or the Retirement Savings Contributions Credit can help you save for your future and reduce your overall tax liability. Here is how it works...

Retirement Savings Contributions Savers Credit | Internal Revenue... The Saver's Credit is a tax credit for eligible contributions to your IRA, employer-sponsored retirement plan or Achieving a Better Life Experience voluntary after-tax employee contributions made to a qualified retirement plan (including the federal Thrift Savings Plan) or 403(b) plan

2021-2022 Retirement Contribution Limits - SmartAsset Catch-Up Contribution Limits. In terms of saving for retirement, you're better off starting sooner rather than later. As an incentive to get more people to save for retirement, the IRS offers a special credit for people who make below a certain amount and contribute to an employer's plan or IRA.

Saver's Credit for 401(k) Plan Contributions Also known as the retirement savings contribution credit, the Savers Credit encourages lower-income employees to save for retirement by giving them a tax credit based on a percentage of their contribution. It can apply to 401(k) plans, IRAs, and other retirement plans.

Who Can Claim the Retirement Savings Contribution Credit? How to Calculate the Retirement Savings Contribution Credit. For married people filing jointly, the maximum credit is $4,000. If your income is below the thresholds we've listed here and you contribute to a retirement savings plan, you may be eligible for the Retirement Savings Contribution Credit.

Which Retirement Accounts Qualify for the Credit? - TheStreet The tax credit, once known as the Retirement Plan Contribution Credit and now known simply as the "Saver's Credit," provides a special tax break to Let's get the word out on the credit, and let's start by taking a closer look at the Saver's Credit and how it might fit your unique tax saving needs.

Saving For Retirement: How Meet Your Retirement Saving... - Fidelity Saving for retirement takes financial planning, and is by no means easy. Learn how to stay on track Get your Fidelity Retirement ScoreSM—it's like a credit score for retirement. 1. Fidelity's suggested total pretax savings goal of 15% of annual income (including employer contributions) is based on...

How This Tax Credit for Retirement Investing Can Save You Up to... By claiming the Retirement Savings Contributions Credit (Saver's Credit), you can get a percentage of your contributions toward eligible retirement Tax credits like this offer some of the most valuable savings you can get at tax time. Unlike a tax deduction, which reduces the amount of taxable income...

Retirement Savings Contributions Credit... | TaxConnections Retirement Savings Contributions Credit (Saver's Credit). Written by IRS | Posted in IRS Announcement. The amount of the credit is 50%, 20% or 10% of your retirement plan or IRA or ABLE account contributions depending on your adjusted gross income (reported on your Form 1040...

Registered retirement savings plan - Wikipedia A registered retirement savings plan (RRSP) (French: régime enregistré d'épargne-retraite, REER), or retirement savings plan (RSP), is a type of financial account in Canada for holding savings and investment assets.

Saver's Credit - Get It Back | Individual Retirement Accounts Individual Retirement Accounts. Contributions to both traditional and Roth IRAs are eligible for the Saver's Tax Credit. Workers that can deduct IRA contributions can do so and also claim the credit. Workers must complete IRS Form 8880,"Credit for Qualified Retirement Savings Contributions...

Contribute to a Saver's Credit Qualifying Retirement Account This retirement savings contributions credit can be claimed in addition to any tax deduction you earn by contributing to a traditional retirement account. There are several types of retirement accounts that might qualify you for the saver's credit. Contributing to a 401(k) plan will often allow you to claim...

/IRSForm8880-7d0c81ec36474e89b8dcbea8c7ced5fc.jpg)

/eliminating-expenses-one-by-one-865786622-7ba313c98b7241bab9dc3619ae13c9d6.jpg)

/portrait-of-pensive-business-woman-wearing-glasses-at-workplace-in-office--young-handsome-female-worker-using-modern-laptop-1188205076-9e7e31f3895347a180afefba64320aaa.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/focused-female-it-professional-holding-document-while-looking-at-computer-in-creative-office-1171809278-a1aa73d9e79d4b8d921a86882a6ebd3f.jpg)

/IRSForm8880-7d0c81ec36474e89b8dcbea8c7ced5fc.jpg)

0 Response to "41 retirement saving contribution credit"

Post a Comment