40 arizona department of revenue

Log On - AZTaxes - Arizona Department of Revenue AZ Web File. Please enter your Username and password. Register if you don't have an account. Forms | Arizona Department of Revenue Your Responsibilities as a Tax Preparer. Penalty Abatement Request: Use Form ...

Arizona Department of Revenue | Arizona State Library The Arizona Department of Revenue was established in 1973 to administer Arizona's tax laws (Laws 1973, Chapter 123, effective July 1, 1974). Statutory authority is outlined in two titles of Arizona Revised Statutes: Title 42 - Taxation and Title 43 - Taxation of Income. Regulatory rules are found in the Arizona Administrative Code, Title 15.

Arizona department of revenue

ARIZONA DEPARTMENT OF REVENUE Arizona Department of Revenue is $200. Class C licensees file monthly financial reports and pay 2.0% of their gross receipts as a bingo tax. Qualified organizations applying for a new bingo license are urged to apply for a Class B license instead of a Class C license. This saves the organization money on its license and bingo tax. If Arizona Department of Revenue - GovDelivery Email Updates. To sign up for updates or to access your subscriber preferences, please enter your contact information below. Subscription Type. Email SMS/Text Message. Wireless Number. 1 (US) 1. Email Address. Name. Contact - AZDOR 8:00 am - 5:00 pm MST(Arizona) Monday through Friday. Mailing Address: Arizona Department of Revenue ATTN: Debt Setoff PO BOX 29070 Phoenix, AZ 85038-9070 Phone Number: (602) 716-6262 Email Address: DSO@azdor.gov

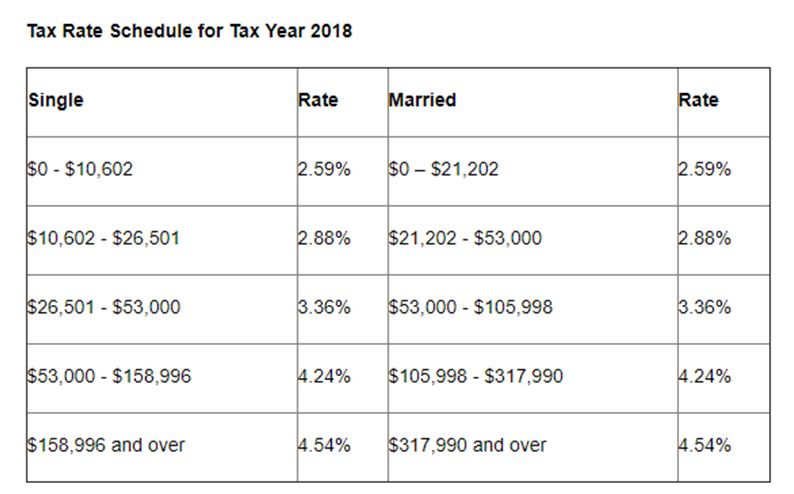

Arizona department of revenue. Arizona Department of Revenue - AZDOR Friday, March 18, 2022 Phoenix, AZ- The Arizona Department of Revenue (ADOR) wants to remind you that income tax returns are due one month from today, on Monday, April 18, 2022. Read More TPT Filer - Please Submit Your Return March 2022 Friday, March 18, 2022 Taxpayers can file now and schedule payments up until the deadline. Read More Individual RV - Revenue, Department of | AZ Direct - Arizona Arizona Tax Forms Toll-free: (800) 352-4090 (International calls and from area codes 520 and 928 only) Live Chat (For general questions only) Where's My Refund? | Arizona Department of Revenue Also, if an individual receives a phone call from ADOR requesting additional ... Printable Arizona Income Tax Forms for Tax Year 2021 Arizona has a state income tax that ranges between 2.59% and 4.5%, which is administered by the Arizona Department of Revenue.TaxFormFinder provides printable PDF copies of 96 current Arizona income tax forms. The current tax year is 2021, and most states will release updated tax forms between January and April of 2022.

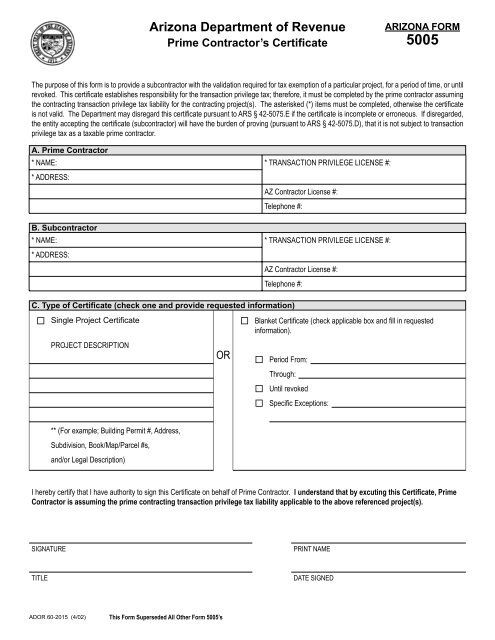

PDF Arizona Department of Revenue - Arizona Auditor General 2910 NORTH 44thSTREET • SUITE 410 • PHOENIX, ARIZONA 85018 • (602) 553-0333 • FAX (602) 553-0051 April 16, 2015 Members of the Arizona Legislature The Honorable Doug Ducey, Governor Mr. David Raber, Director Arizona Department of Revenue Transmitted herewith is a report of the Auditor General, View 1099-G - AZTaxes Welcome to Arizona Department of Revenue 1099-G lookup service. The department is now providing Form 1099-G online instead of mailing them. Form 1099-G reports the amount of income tax refunds including credits or offsets that we paid to you in a tax year if you itemized your federal deductions. PDF Form 5000 - Arizona Transaction Privilege Tax Exemption ... Arizona Department of Revenue Transaction Privilege Tax Exemption Certifi cate ADOR 60-2010 (12/04) Reason for Exemption - check as applicable 1. Tangible personal property to be resold in the ordinary course of business. 2. Tangible personal property to be leased or rented in the ordinary course of business. 3. ARIZONA DEPARTMENT OF REVENUE - azstatejobs.gov The Arizona Department of Revenue is consistently striving towards recruiting individuals who are committed to providing quality services to citizens of Arizona and are passionate about creating solutions to the ever-evolving decisions faced within the state government.

Arizona Department of Revenue warns of identity theft this ... (The Center Square) - The Arizona Department of Revenue is warning Arizona residents of a heightened risk of identity theft amid tax season. The department says that recent schemes have used phone calls, emails, or text to get information like Social Security Numbers (SSN), passwords, or banking information. State of Arizona Department of Revenue AZTaxes.gov allows electronic filing and payment of Transaction Privilege Tax (TPT), use taxes, and withholding taxes. Arizona Department of Revenue holding auction to find ... The Arizona Department of Revenue is opening its vault this week to put an assortment of unclaimed property up for auction. Sierra Auction will conduct the online auction, which lasts until ... PDF Arizona Department of Revenue - Arizona Auditor General Arizona Office of the Auditor General 2910 N. 44th St. Ste. 410 Phoenix, AZ 85018 (602) 553-0333 ARIZONA AUDITOR GENERAL LINDSEY A. PERRY MELANIE M. CHESNEYJOSEPH D. MOORE DEPUTY AUDITOR GENERAL DEPUTY AUDITOR GENERAL 2910 N 44thST • STE 410 • PHOENIX, AZ 85018 • (602) 553-0333 •

ARIZONA DEPARTMENT OF REVENUE - 43 Reviews - Public ... Specialties: Tax laws that fall under the department's purview are primarily in the areas of income, transaction privilege (sales), use, luxury, withholding, property, estate, fiduciary, bingo, and severance. Established in 1974. The Department of Revenue's origins predate Arizona statehood. The State Tax Commission, established in 1912, consisted of a three-member, non-partisan board elected ...

Arizona | Internal Revenue Service Arizona Commerce Authority. Taxation. Arizona Department of Revenue AZTaxes.gov. Employer Links. Industrial Commission of Arizona Arizona Department of Economic Security New Hire Reporting Center. General. Small Business Administration - Arizona Agency List Arizona Revised Statutes Arizona State Procurement Small Business Services Arizona Counties

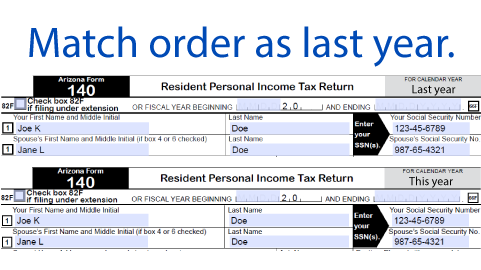

Printable Arizona Income Tax Forms for Tax Year 2021 Arizona has a state income tax that ranges between 2.590% and 4.500% . For your convenience, Tax-Brackets.org provides printable copies of 96 current personal income tax forms from the Arizona Department of Revenue. The current tax year is 2021, with tax returns due in April 2022.

AZTaxes - Arizona Department of Revenue AZTaxes - Arizona Department of Revenue Home Register Resources Contact Us Welcome to AZ Web File! AZ Web File is available to Payroll Service Providers to save time, money and paper and to meet the requirements to electronically file and pay Employer Withholding.

Contact Us | Arizona Department of Revenue COLLECTIONS ; Individual or Business Collections Questions: (602) 542-5551. Fax:

Arizona Department of Revenue holding Unclaimed Property ... The Arizona Department of Revenue is holding an online public auction of unclaimed property items starting Wednesday, Jan. 19 at 3:00 p.m.

Arizona Department of Revenue | LinkedIn The mission of the Arizona Department of Revenue is to Serve Taxpayers! It is our vision that we set the standard for tax services. Tax laws that fall under the department's purview are ...

AZTaxes State of Arizona Department of Revenue Toggle navigation. Home; License Verification; Individual . Check Refund Status

Arizona Department of Revenue - Facebook Arizona Department of Revenue. 13 hrs ·. Meet Mina! She is a QA Analyst in our IT team and has been with ADOR for almost 8 years. She provides excellent customer services to the agency by testing all tax applications to ensure no errors. #IHeartADOR. 33. Like Comment Share. Arizona Department of Revenue.

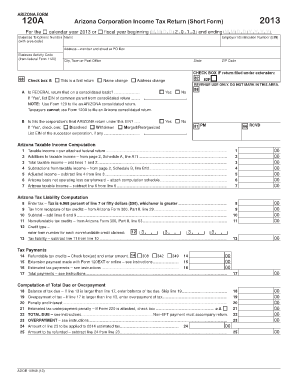

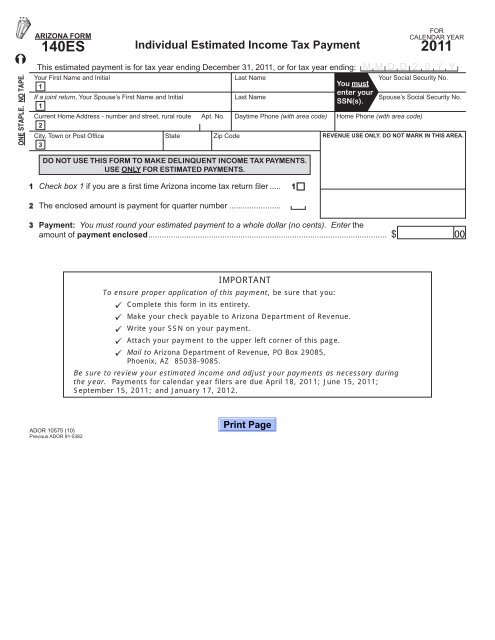

Arizona Tax, Arizona Department of Revenue, Corporate and ... To learn more about nonprofit filings, see our Arizona nonprofit corporation page. Estimated tax payments? Form 140ES if income in the current or prior years will be $75,000 or more for a single filer, or $150,000 for a married joint filer. Arizona Department of Revenue: Arizona Department of Revenue PO Box 29079 Phoenix, AZ 85038-9079

Arizona Department of Revenue Phone Number | Call Now ... While 602-255-3381 is Arizona Department of Revenue's best toll-free number, there are 2 total ways to get in touch with them. The next best way to talk to their customer support team , according to other Arizona Department of Revenue customers, is by calling their 800-352-4090 phone number for their Customer Service department.

Solved: Can anyone give me the arizona federal id number ... I have emailed the state DOR, and have had great success getting a quick response as well. Of course when your from Kansas, most states think of fields of wheat and corn - and it helps. Especially NY & DC & CA. Mailing address of Shawnee Mission - hell, they think I live on a reservation - I have been asked that 😉. 0 Cheers.

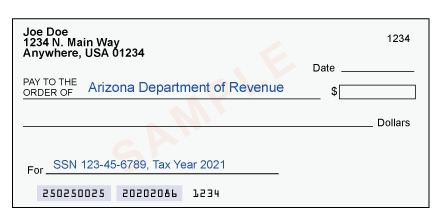

Mailing Addresses | Arizona Department of Revenue Use the following addresses when mailing a return or payment to the Arizona ...

Locations and Services | Arizona Department of Revenue AZTaxes.gov for filing & payment of Transaction Privilege Tax and Withholding ...

PDF Arizona Department of Revenue STATE OF ARIZONA EMAIL: GARNISHMENTS@AZDOA.GOV DEPARTMENT OF ADMINISTRATION PHONE: (602) 542-6082 . 100 NORTH 15TH AVENUE, SUITE 302 FAX: (602) 364-2215 . PHOENIX, ARIZONA 85007 . What documents are you required to mail to me?

Arizona State Tax Tables 2021 | US iCalculator™ The Arizona Department of Revenue is responsible for publishing the latest Arizona State Tax Tables each year as part of its duty to efficiently and effectively administer the revenue laws in Arizona. Tax rates and thresholds are typically reviewed and published annually in the year proceeding the new tax year.

Business | Arizona Department of Revenue The goal of the Arizona Department of Revenue (ADOR) is to help business owners ...

Unclaimed Property | ADOA - Arizona In the State of Arizona, the Department of Revenue is responsible for managing Unclaimed Property . The State of Arizona Surplus Property Management Office does not manage the disposal of Unclaimed Property.

Contact - AZDOR 8:00 am - 5:00 pm MST(Arizona) Monday through Friday. Mailing Address: Arizona Department of Revenue ATTN: Debt Setoff PO BOX 29070 Phoenix, AZ 85038-9070 Phone Number: (602) 716-6262 Email Address: DSO@azdor.gov

Arizona Department of Revenue - GovDelivery Email Updates. To sign up for updates or to access your subscriber preferences, please enter your contact information below. Subscription Type. Email SMS/Text Message. Wireless Number. 1 (US) 1. Email Address. Name.

ARIZONA DEPARTMENT OF REVENUE Arizona Department of Revenue is $200. Class C licensees file monthly financial reports and pay 2.0% of their gross receipts as a bingo tax. Qualified organizations applying for a new bingo license are urged to apply for a Class B license instead of a Class C license. This saves the organization money on its license and bingo tax. If

0 Response to "40 arizona department of revenue"

Post a Comment